Discover actionable investment strategies to protect and grow your wealth during market volatility. Learn how to navigate uncertainty with confidence.

Introduction

Volatile markets—whether driven by inflation, geopolitical tensions, or interest rate hikes—can test even seasoned investors. With India’s Nifty 50 swinging by over 15% in 2023 and global markets facing similar turbulence, having a robust strategy is critical. This guide breaks down 7 data-backed investment strategies to help you thrive in unpredictable times, with insights tailored to India’s unique economic landscape.

AI and Automation: Revolutionizing the Indian Stock Market in 2025-26

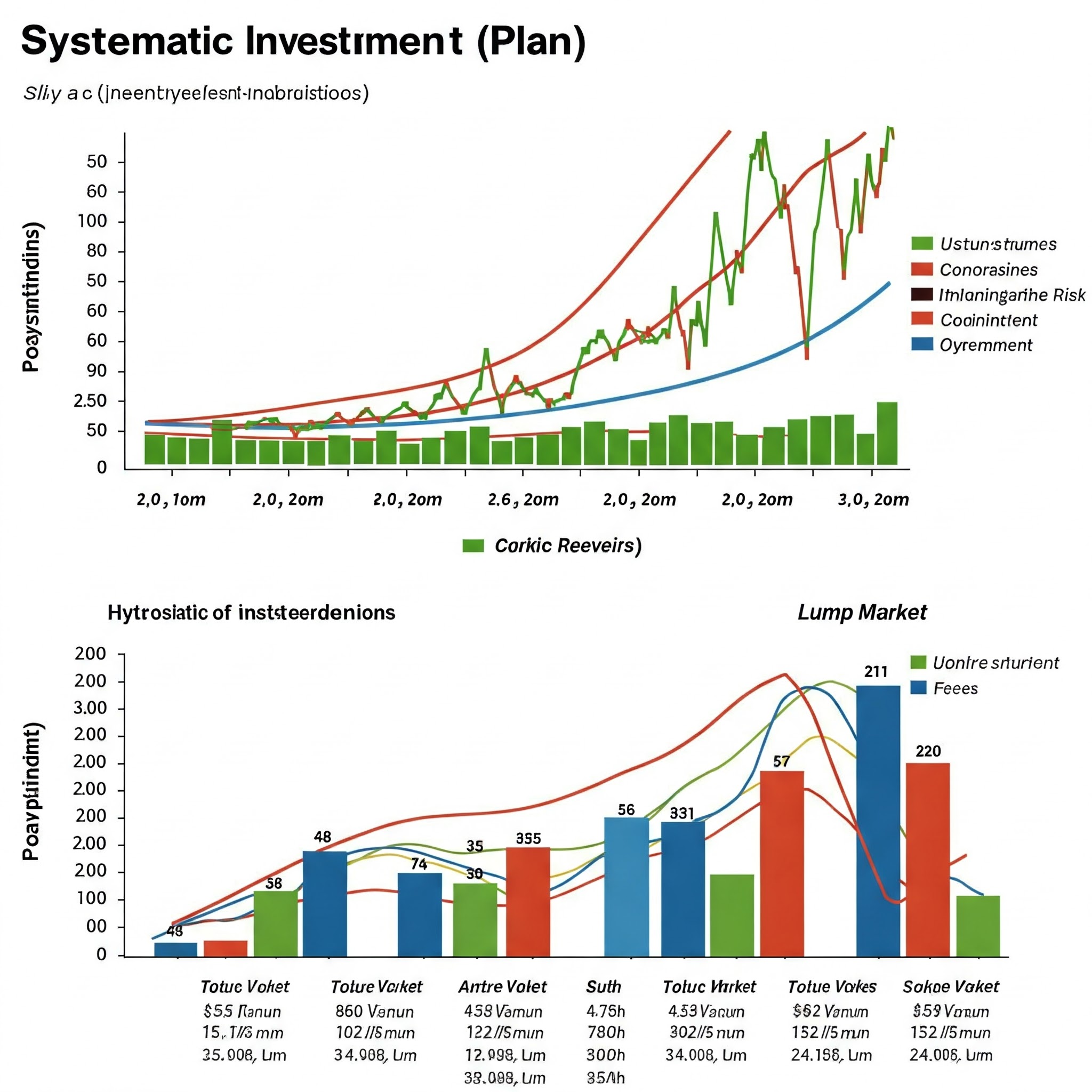

1. Embrace Dollar-Cost Averaging (DCA)

DCA involves investing fixed amounts at regular intervals, regardless of market conditions. This strategy minimizes emotional decisions and lowers the risk of buying at peaks.

-

Example: If you invest ₹10,000 monthly in an index fund, you buy more units when prices dip and fewer when they rise, averaging out costs.

-

India Focus: SIPs (Systematic Investment Plans) in mutual funds surged to ₹15,245 crore/month in 2023, proving DCA’s popularity during volatility.

2. Prioritize Quality Over Hype

In volatile markets, blue-chip stocks and AAA-rated bonds often outperform speculative assets.

-

Defensive Stocks: Companies in sectors like FMCG (e.g., Hindustan Unilever) and pharmaceuticals (e.g., Sun Pharma) tend to remain stable due to consistent demand.

-

Debt Instruments: Consider short-term government securities (T-Bills) or corporate bonds with high credit ratings.

-

Top Performing Indian Stocks in 2025: Expert Picks for High Growth

AI and Algorithmic Trading

3. Diversify Beyond Traditional Assets

Diversification isn’t just about stocks and bonds. Explore alternatives:

-

Gold ETFs: Gold prices rose 12% in 2023 amid global uncertainty; ETFs like Nippon India Gold ETF offer liquidity and safety.

-

Real Estate Investment Trusts (REITs): Earn rental income from commercial properties without physical ownership.

-

International Exposure: Invest 10–15% in global equity funds (e.g., US S&P 500 ETFs) to hedge against local market risks.

-

Why Is the Share Market Down Today? Key Reasons Behind the Sudden Dip

4. Use Stop-Loss Orders Strategically

A stop-loss automatically sells a stock when it hits a predetermined price, limiting losses.

-

Case Study: During the Adani stock crash, investors with stop-loss orders at 10% below purchase prices minimized losses compared to those holding blindly.

-

Tip: Adjust stop-loss levels based on stock volatility (use metrics like Beta).

5. Rebalance Your Portfolio Quarterly

Market swings can skew your asset allocation. Rebalancing ensures alignment with your risk tolerance.

-

Example: If equities grow from 60% to 70% of your portfolio, sell some stocks and reinvest in underweight assets like debt or gold.

-

Tool: Apps like Groww and Kuvera offer automated rebalancing for mutual fund portfolios.

-

7 Proven Investment Strategies for Volatile Markets

6. Hedge with Inverse ETFs and Options

Advanced investors can hedge using instruments that profit when markets fall:

-

Inverse ETFs: ETFs like Nippon India ETF Nifty 1D Rate Inverse rise when Nifty falls.

-

Put Options: Buy put options on indices or stocks to lock in selling prices, acting as an insurance policy.

7. Stay Liquid with Emergency Cash Reserves

Maintain 6–12 months of expenses in liquid assets (savings accounts, liquid mutual funds) to avoid panic selling during downturns.

-

Stat: RBI reports Indian households held ₹15.8 lakh crore in liquid deposits as of July 2023, reflecting heightened caution.

Psychological Edge: Avoid These 3 Mistakes

-

Chasing “Hot Tips”: Viral stock picks (e.g., recent SME IPOs) often lead to losses.

-

Overreacting to News: Ignore short-term noise; focus on long-term fundamentals.

-

Stopping SIPs: 74% of SIP investors who continued through 2020–2022 volatility saw positive returns (AMFI data).

Case Study: How a Conservative Investor Outperformed in 2023

Profile: 45-year-old Mumbai-based investor with ₹1 crore portfolio.

Strategy:

-

50% in large-cap equity funds

-

30% in corporate bonds

-

15% in gold ETFs

-

5% in cash

Result: Despite a 10% Nifty correction, their portfolio dipped only 4% due to diversification.

Future-Proofing: AI-Driven Tools for Volatile Markets

-

AI Risk Analyzers: Platforms like Smallcase use machine learning to predict portfolio risks.

-

Robo-Advisors: Upstox’s “WealthBaskets” auto-adjust asset mixes based on market conditions.

FAQ: Your Volatile Market Questions Answered

Q1: Which sectors perform best in volatile markets?

A: FMCG, healthcare, and utilities (e.g., Tata Consumer, Dr. Reddy’s).

Q2: Should I sell stocks during a crash?

A: Only if fundamentals weaken. Use crashes to buy quality stocks at discounts.

Q3: How much cash should I hold?

A: Aim for 10–15% of your portfolio for emergencies and opportunistic buys.

Conclusion

Volatility isn’t a threat—it’s an opportunity for disciplined investors. By combining strategies like DCA, diversification, and hedging, you can turn market chaos into long-term gains. Stay informed, avoid emotional traps, and leverage tools like SIPs and AI advisors to navigate India’s dynamic markets.

Keywords: investment strategies volatile markets, SIP during market crash, best stocks for volatility India, how to hedge investments, portfolio rebalancing India