what are returns on equity investment? and what type of returns on equity investment? all information is available is hear. just click here.

There are four ways by which you earn returns through equities – dividend, bonus, rights, and capital appreciation. Further, there are various costs associated with equity investing – brokerage, STT, service tax, turnover tax, and stamp duty… To arrive at the true returns that your investment has generated you will have to account for all of the above-stated corporate actions and costs. You can take the following steps:

Step 1: Arrive at the total purchase cost

When you purchase your shares, you must make a note of the cost of the shares and the number of shares that you have purchased. You must add to this amount the Securities Transaction Tax (STT), stamp duty, service tax, turnover tax, and brokerage that is paid on these shares and stock. Suppose you buy 100 shares of ABC Limited at a cost of Rs. 10000. Apart from this cost, you will have to pay brokerage. If the brokerage rate is 0.5%, it will work out to be Rs. 50. STT at the rate of 0.125%, will work out to be Rs. 12.50, stamp duty and turnover tax will work out to be Rs. 0.25 and 0.35 respectively. Service tax on brokerage will amount to Rs. 6.18. Thus for arriving at your total cost, all these elements will be added up.

Your total acquisition cost will hence be Rs 10069.28 and per share cost Rs. 100.69.

Hey Get The Best Angel One Account Opening Offers In 2022

Step 2: Account for all the corporate actions

While holding on to shares, you may receive:

a. Dividend

Dividends are tax-free in the hands of the investor and accordingly, you must consider the whole amount as part of your returns. Suppose the company declares a dividend at the rate of 20%. The total amount to be received by you will work out to be Rs. 200 (assuming the face value of each share bought by you is Rs. 10). Here 200=100x10x20/100.

b. Bonus shares

Since bonus shares attract no purchase cost, post bonus, your holding will increase without any increase in the corresponding purchase cost. You are holding 100 shares of Company ABC. However, your purchase cost remains the same i.e. Rs 10,000. Therefore, your cost of purchase per share from the earlier Rs 100 (Rs 10,000 / 100 shares) stands reduced to Rs 67 (Rs 10,000 / 150 shares).

c. Rights

Since rights, give you an option to buy additional shares of the company at a price lower than the market price, subscribing to rights will allow you to increase your holding with a limited increase in the purchase cost. You hold 100 shares of Company ABC and the current market price of each share is Rs 150. The company announces a rights issue of 1:5 at Rs 60. This means that for every 5 shares that you hold you are entitled to receive one share and you will have to pay the discounted price of Rs 80 per share. Since you hold 100 shares, if you opt for the rights you will receive 20 shares (1 x 100/5) at a total cost of Rs 1200 (Rs 60 x 20 shares). If the acquisition cost of the original 100 shares was Rs. 10000, your total cost of 120 shares will be Rs. 11200 and cost per share will reduce to Rs. 93.33.

In the earlier page on how to compute returns on your equity investments, we have thrown light on the first two steps that you should take towards computing the returns. On this page, we will see how to complete the process by taking the remaining steps.

Step 3: Selling the shares.

At the time of selling your shares, you have to bear brokerage, Securities Transaction Tax (STT), stamp duty, service tax, and turnover tax. This will reduce sale proceeds…

In the above example, suppose you sell 100 shares at Rs. 12000, them again you will have to pay a brokerage (Rs. 60), STT (Rs. 15), stamp duty (Rs. 0.30), service tax (Rs. 7.42), and turnover tax (Rs. 0.42). Thus your sale proceeds will be deducted by this amount of Rs. 83.14 and your net proceeds will be Rs. 11916.86.

Do You Know The Best App For Forex Trading In India In 2022

Step 4: Impact of the holding period.

The gains that you make on your equity and stock investment are termed as ‘capital gains’ and attract tax depending on the investment term… If the investment term is greater than 12 months, the gains are termed as ‘long term capital gains’ and attract no tax. If the investment term is less than 12 months, the gains are termed as ‘short term capital gains and attract tax at the rate of 16.995 percent (inclusive of surcharge and education cess 3 percent).

Step 5: The tax liability

If the gains are short-term, you will have a tax liability of 16.995 percent of the gains (inclusive of surcharge and education cess 3 percent)…

If the gains are long-term, there is no tax liability…

If as per the above example, you hold 100 shares for a period of more than 12 months, gains made by you i.e. 1847.58 (Rs. 11916.86- 10069.28) will be exempt from tax. If however, you sell within 12 months, your short-term tax liability will work out to be Rs. 314 (1847.58X16.995/100).

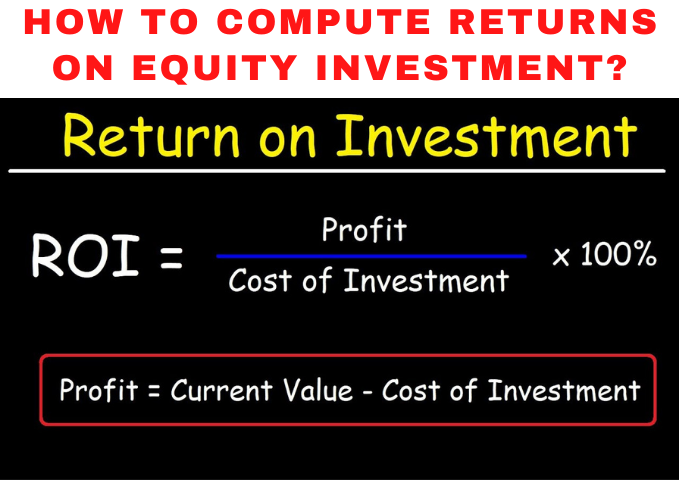

Step 6: Absolute and Annualised returns

Absolute returns are returns wherein the investment term is not taken into account.

It also pays to consider absolute and annualized returns for the purpose of computation of your total returns. Suppose you buy 100 shares of company ABC Limited for Rs. 15000 on January 01, 2008, and sell all your holdings on March 31, 2008, for Rs. 18000. In this case, you make a profit of Rs. 3000 on an investment of Rs. 15000. Hence your absolute returns expressed in terms of percentage is 20% (3000”100/15000).

In the case of annualized returns, the investment term is taken into account, and then annualized to arrive at the correct picture…

Get High Profit With Ether Share, Do You Know Ether Share Price Today

As per the above example, as you have made these returns over a period of just 3 months, your annualized returns are 80% (3000x100x12/15000×3).

4 thoughts on “How to compute returns on equity investment?”